Christyne Gray, founder of She Profits Now, has spent the last 25 years coaching high-achieving women toward profitable and impactful businesses. She Profits Now offers retail professional services, such as bookkeeping, tax return preparation, and money clarity coaching, along with do-it-yourself training courses for “Mastering QuickBooks Online for Your Boutique” and “Profit First” in the boutique retail industry.

Christyne’s mission is to teach retailers:

- The economics of running a retail company

- How to maintain an accurate and up-to-date accounting system

- The importance of knowing your numbers

- How to implement and live a profit-first lifestyle

The CommentSold team caught up with Christyne to ask her some of the most frequent questions from boutique owners regarding tax deductions.

Christyne’s ‘Common Sense’ Tax Write-Off Rule

Tax code is complex, and in most instances, it is up to the business owner and their tax professional to decipher the intent of any particular tax code. At She Profits Now, we apply a “common sense” rule of thumb to guide our clients in making decisions relevant to what can legitimately be deducted versus what is risky to deduct.

This rule of thumb is that an expense must benefit the business and its ability to generate revenue more than the expense benefits the business owner personally.

Most questions about what can and cannot be deducted can be resolved using this “common sense” rule of thumb. So, let’s apply this to some of the most frequently asked questions relevant to deductible expenses in the retail industry.

Top 10 Tax Deduction FAQs

Question #1: I am the face of my business. I model and sell live. Can I write off my BOTOX? What about my hair appointments and nails?

Answer: There are Supreme Court cases that disallow national TV news professionals from deducting their beauty treatments and routines. This makes for a fairly solid case in our industry that if audited, these expenses would be disallowed. However, you can get creative with your promotional and ambassador partnerships. Consider a relationship where you are promoting your local spa or salon provider in exchange for services.

Question #2: Being a boutique owner is stressful! Can I write off my massages and self-care?

Answer: Our common-sense rule of thumb will definitely apply to massages and self-care. It would be difficult to claim that your business benefits from this expense more than you do personally. Again, get creative in your promotional relationships.

Question #3: I always represent my fashion brand in public. Can I write off the clothes from my inventory that I keep for myself?

Answer: In the event that you are actively promoting a product that is on your sales floor and available for purchase, and sales are generated by you wearing the product and being a live mannequin and display, you may be safe in justifying your use of the product. Consider tracking this “marketing” use so that you fully understand how much you are consuming for justification purposes.

Question #4: I could really use your bookkeeping services. Can you write off fees to service providers? What about things like The Boutique Hub and CommentSold?

Answer: Yes, all of your professional services—She Profits Now, professional accounting, tax and money coaching services, memberships such as The Boutique Hub, and subscription services such as CommentSold—are 100% tax-deductible and 100% worth your investment.

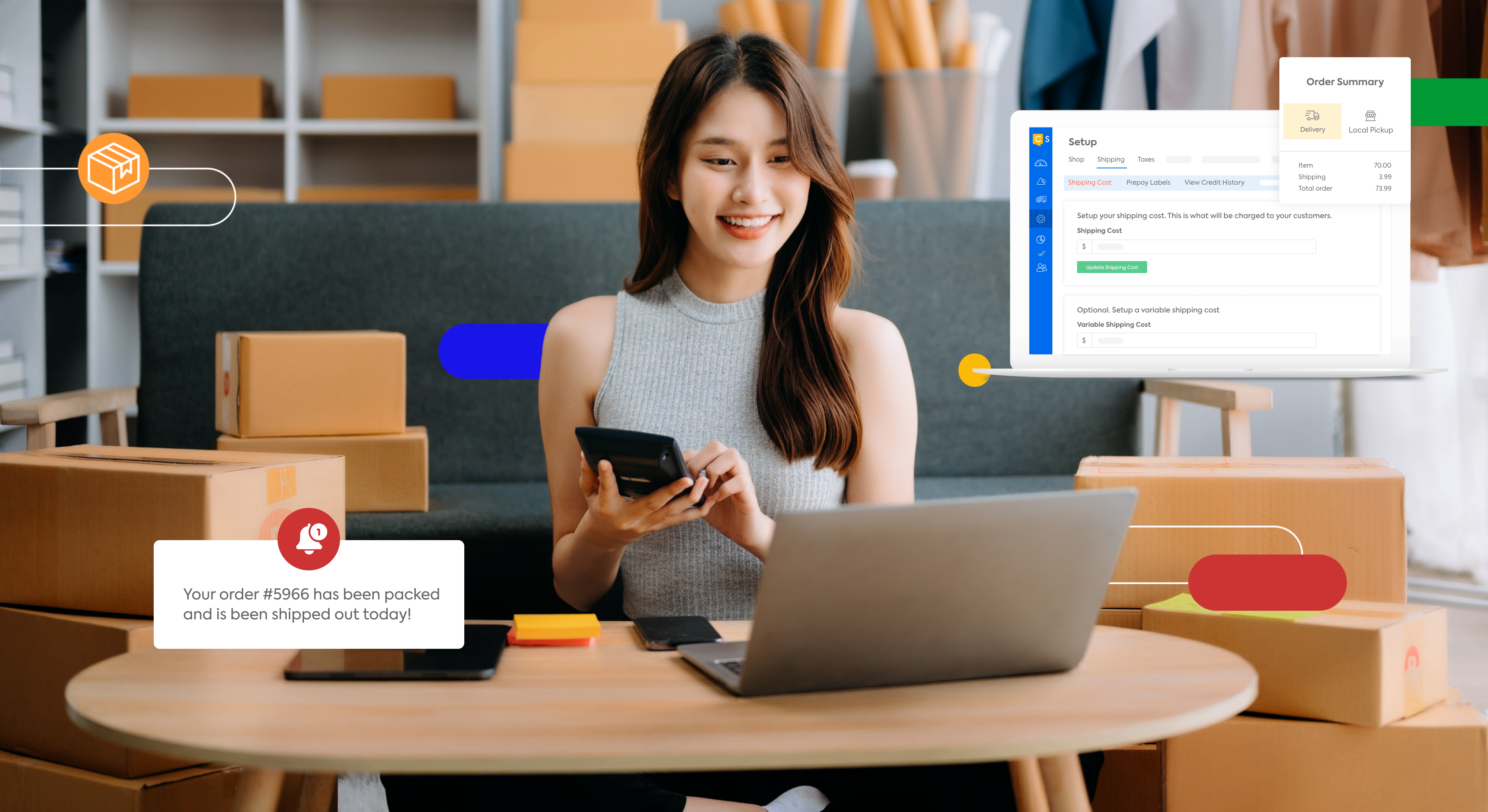

Question #5: The cost of shipping just keeps going up! Any write-offs there?

Answer: Shipping costs, whether you are paying freight in charges to receive your inventory, or freight out charges to ship to your customer, are 100% tax-deductible.

Question #6: I sometimes receive damaged goods, or customers will return items and I can’t resell them. Can I recoup anything at tax time?

Answer: Yes, costs of what we call “shrinkage” in the industry are 100% deductible. Shrinkage includes loss from theft, damage, or loss. You can expense the cost of the item, not the retail value.

Question #7: We like to live it up when we go to market. Could we get any money back on all those fancy dinners with our employees?

Answer: Meals consumed while traveling can be 100% deducted, as long as you can prove that the meal was indeed for business purposes. If you were to play it safe, you would deduct the meals for your travel days and days at market, but not for days that are “book-ends” to your trip used for personal enjoyment.

It is also important to say in touch with fair and reasonable enjoyment while conducting business. If audited, an IRS agent would not consider nights out in a Las Vegas nightclub as benefiting your business and its ability to produce revenue. Again, apply our “common sense” rule of thumb.

Question #8: I run my boutique out of my home. Can I write off home office space?

Answer: Absolutely! You are eligible to write off the business use of your home. To do this, we track the square footage of your business space, relevant to your entire home, and apply that percentage to costs, such as mortgage interest, utilities, maintenance, etc. If you do not want to track these details, there is a standard deduction of $150 per month or $1,500 annually for business use of a home that can be applied to your tax return.

Question #9: Cell phone bill, Internet costs…all of those things add up. Please tell me what I can write off there!

Answer: All of the above can be written off 100%. I will argue in an audit that your cell phone and use of the Internet are 100% contributing to your ability to produce revenue, given we manage our businesses and social media position 24/7 in this industry.

Question #10: Mileage—do I really have to keep track, or can I just make up a number? Any tips for writing off mileage?

Answer: It’s so easy to be passive when it comes to mileage, but please understand that automobile and mileage deductions are red-flag items on a tax return. For this reason, we want to have our record-keeping in order. You are eligible to write off 100% business use of your automobile or mileage with proof. We recommend you use the MileIQ app to assist in your record-keeping efforts.

The Takeaway

There are several ways boutique owners can pinch pennies and make legitimate deductions during tax season. When it comes to navigating your finances as a retail business owner, having the right support system and an expert coach or mentor can help clear up any misunderstandings or questions. To learn more about Christyne’s boutique coaching and services, visit sheprofitsnow.com.