Every online boutique aspires to convert more customers, increase their average order value, and reduce cart abandonment rates.

While advertising and frictionless checkout methods contribute to these goals, many retailers are using Sezzle to supercharge their results. Here’s how it works and why your business should offer it too.

What Is Sezzle & How Does It Work?

Buy now pay later (BNPL) is a checkout option in which retailers can offer their consumers financing options for their customers. It gives consumers more freedom, confidence, and purchasing power than any other payment method.

Sezzle, the leading BNPL payment gateway in the U.S., gives customers the option to receive their items right away while budgeting their purchases. Payments are interest-free and typically made over with four installments over the span of six weeks.

For retailers, it’s the choice BNPL option. Sezzle assumes the risk of the customer so that retailers get paid upfront without the worry of fraud or non-payment.

Plus, Sezzle’s benefits extend far beyond facilitating transactions. Their flexible payments consider buyer psychology and mobile shopping behaviors that can give you more benefits than you can imagine.

Reach New Customers

Certain demographics may be interested in your products and services. However, they don’t have an obvious way to budget their purchases.

For example, young buyers, like Millenials and Gen Z, have unparalleled buying power. However, they also have extreme debt aversion. The majority don’t even own a credit card! Sezzle opens up opportunities for these demographics to shop with you, build their credit, and budget shopping expenses without worry.

It also helps convert first-time visitors when the timing is less than ideal. Perhaps someone has just discovered your brand and wants to make a purchase, but they don’t get paid until next week.

Your shop may become an afterthought by the time payday rolls around. With Sezzle, you can capture customers that aren’t otherwise equipped to make a purchase at the peak of their interest.

Improve Checkout & Convenience

Cumbersome checkout can damage the customer experience and cause you to miss out on sales. Alternative payment solutions offer a path of least resistance for eager shoppers to check out quickly.

Your customers don’t need to fumble with cards or type in account numbers every time they need to make a transaction. After initial signup, they can check out with only a few clicks.

While optimized checkout is vital for all sales channels, it needs to remain exceptionally simple on mobile devices. Filling out payment information on small devices like these can significantly frustrate customers.

Google research shows that 67% of mobile users say that they are more likely to buy a site’s product or service if it’s mobile-friendly.

Sezzle provides effortless checkout for mobile shoppers across all sales channels. Wherever they shop, they can quickly pay their first installment and get on with their day.

Increase AOV & Incremental sales

You can also expect an increase in incremental sales. The ease of BNPL drives repeat purchases and larger cart values by removing financial barriers.

Shopping sprees a non-issue when payment installments make large sums more manageable for consumers. As a result, Sezzle boutiques see an average increase in AOV (average order value) by 22%.

Reduce Cart Abandonment

A portion of cart abandonment rates can be managed by optimizing the checkout process, but there are other more personal reasons for shopper hesitation. In fact, 34% of potential shoppers will abandon their cart because they aren’t ready to buy.

Sezzle considers shoppers’ personal friction points, such as sticker shock from cart totals or the need to postpone purchases until their next paycheck. Now shops can provide a flexible way to pay to reduce financial stressors.

The Takeaway

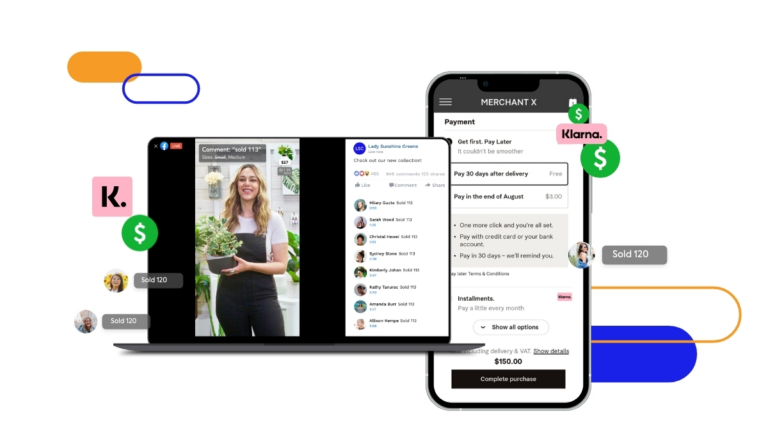

You may have noticed Sezzle, Afterpay, and Klarna displayed on some of the most successful eCommerce websites. The explosive popularity of shop now, pay later solutions are making them a commodity for online retail.

Now you, too, can offer budget-friendly payment options. Use Sezzle to increase sales and customer satisfaction wherever you sell- Facebook pages and groups, Instagram, websites, and mobile apps.